Vietnam and Thailand Manufacturing Quality Comparison: Key Insights for Global Buyers

↵

In the dynamic landscape of global manufacturing and sourcing, Southeast Asia has emerged as a pivotal region for businesses seeking to diversify their production bases. Vietnam and Thailand, in particular, have attracted significant attention from international buyers, enticing them with a combination of cost-effectiveness, strategic geographical locations and expanding industrial capabilities. As companies expand their operations in these countries, one question looms large: where can they expect more reliable production quality?

The importance of consistent and reliable production quality cannot be overstated. In today's competitive global market, products must meet or exceed international standards to earn consumer trust and capture market share. A single batch of substandard products can damage brand reputation, result in costly recalls and lead to customer loss. For businesses operating with tight profit margins and strict production schedules, any disruption caused by quality issues can be a significant setback.

Both Vietnam and Thailand have made remarkable progress in their manufacturing sectors in recent years. Vietnam has experienced a surge in foreign direct investment, particularly in the electronics and textile industries, driven by its young and relatively affordable workforce. Thailand, meanwhile, has a more established manufacturing base, especially in the automotive and electronics industries, known for its skilled labor force and advanced infrastructure in specific regions.

However, beneath these general trends, there are nuances in the quality-related aspects of production in each country. These differences can be attributed to various factors, including the maturity of the manufacturing ecosystem, the level of investment in quality control systems and the regulatory environment. In the following sections, we will explore these factors in depth to provide a comprehensive comparison of production quality and reliability in Vietnam and Thailand, equipping buyers with the knowledge to make informed sourcing decisions.

What Makes Vietnam and Thailand Key Manufacturing Hubs for Global Buyers?

Vietnam and Thailand continue to stand out as two of Southeast Asia’s most preferred sourcing and manufacturing locations for global buyers. Their competitiveness is driven by three core factors: labor advantages, strong industrial clusters and consistent export performance.

1. Labor Competitiveness

Vietnam remains one of the most attractive labor markets in Asia due to its stable and cost-competitive workforce. Manufacturing wages are still significantly lower than those in many other regional production hubs, enabling brands to maintain cost efficiency in high-volume categories such as electronics, apparel, furniture and consumer goods.

Vietnam’s manufacturing growth is driven by labor-intensive export industries, which now account for nearly 85% of the country’s total export value.

Thailand, although it has higher labor costs, offers a more skilled and experienced workforce, particularly in the automotive, electronics and machinery sectors—making it ideal for buyers who require greater precision and consistency.

Thailand’s workforce supports advanced production lines with enhanced technical capabilities, attracting global brands in mid- to high-end manufacturing.

2. Mature Industrial Clusters

Vietnam has rapidly expanded its industrial parks, export zones and manufacturing clusters. These clusters integrate suppliers, assemblers, logistics providers and export facilities, enabling buyers to scale production quickly.The country’s strong industrial expansion is supported by significant infrastructure and FTA-driven trade facilitation.

Thailand offers one of Southeast Asia’s most advanced manufacturing ecosystems.

- Automotive, electronics, petrochemicals and machinery clusters are well established.

- Integrated supply chains allow faster lead times and more stable quality.

For buyers prioritizing reliability and mature production capability, Thailand’s industrial clusters give them strong confidence in consistent output.

3. Strong Export Performance

Vietnam is one of the fastest-growing export economies in the world. Its export manufacturing capacity continues to expand, supported by international trade agreements and efficient logistics networks.

- Processing and manufacturing industries make up 85% of export value, underscoring the country’s global role as an export powerhouse.

Thailand demonstrates resilience in global trade, with exports rising despite regional and international economic challenges.

- I n 2024, Thailand's export value grew by 5.4% year-on-year, supported by diversified export categories including electronics, auto parts, plastics and industrial machinery.

This stability is especially valuable for buyers concerned about delivery consistency and long-term production planning.

Read More: Quality Challenges in Thailand’s Manufacturing Industry

How Does Each Country Perform in Product Quality Across Key Industries?

When it comes to product quality, a detailed analysis of key industries in Vietnam and Thailand reveals important differences.

Clothing and Textile Industry

- In Vietnam, the clothing and textile industry has experienced rapid growth in recent years. The country has become a major global supplier, producing a wide range of products, from basic apparel to high-end fashion items. The quality of Vietnamese-made textiles is generally good, with a strong emphasis on meeting international standards for fabric quality, stitching and colorfastness. However, some concerns remain. In smaller factories that primarily focus on mass production for budget-conscious brands, quality control can be inconsistent. These factories often face challenges in maintaining high-quality standards due to limited resources for advanced quality inspection equipment and a less experienced workforce.

- Thailand's textile industry, on the other hand, has a long-standing reputation for quality. Thai textile manufacturers often invest in high-quality raw materials and advanced production technologies. They are renowned for their expertise in producing silk and other premium fabrics. Many Thai textile and clothing products are sold in high-end international markets, where strict quality standards prevail. Thai companies also place a strong emphasis on design and finishing touches, which enhances the overall perception of their products' high quality.

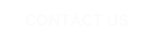

The Asia-Pacific region (dark blue) as the dominant leader with the highest growth rate. North America follows with moderate expansion shown in medium blue, while Africa and the Middle East are shaded in light blue to represent emerging or lower growth. Conversely, the grey shading across Europe, South America and Australia suggests these areas are currently experiencing the lowest growth or stagnation relative to the other regions.

↵

Workforce Characteristics

Thailand

- Thailand's workforce possesses distinct characteristics that impact production quality across various industries. The country has made significant strides in education, boasting a high literacy rate of approximately 96.3%. As of 2024, about 30% of the workforce has attained some form of post-secondary education, providing a strong foundation for a more skilled labor force.

- In the manufacturing sector, there is a substantial pool of workers with specialized skills. In the automotive industry, workers possess in-depth knowledge of vehicle assembly, engine production and quality control processes. This expertise stems from Thailand's long-standing presence in automotive manufacturing, which has fostered the development of a workforce with industry-specific skills. Similarly, Thai workers in the electronics industry are well-trained in areas such as circuit board assembly and component testing, enabling them to produce high-quality electronic products.

- The service-oriented nature of the Thai workforce significantly contributes to product quality. Thai workers are renowned for their attention to detail and customer-centric approach. In industries such as food processing, this results in rigorous quality control during production, ensuring that food products meet high standards of taste, safety and packaging. Additionally, the cultural emphasis on respect and harmony fosters a positive work environment, which leads to more motivated employees and, consequently, higher-quality production.

Vietnam

- Vietnam’s workforce possesses distinct characteristics that drive production quality across its key export industries. The country benefits from a strong foundational education system, boasting an impressive adult literacy rate of approximately 97.8%.

- In the manufacturing sector, the workforce is characterized by high dexterity and rapid adaptability. In the electronics industry. Now Vietnam's largest export sector—workers have acquired specialized skills in micro-assembly, circuit board testing and surface mount technology (SMT). This expertise has been cultivated through the presence of global tech giants, which have established massive training ecosystems in the country. Similarly, in the textile and garment industry, Vietnamese workers are renowned for their needlework skills and ability to handle complex garment construction, ensuring that apparel products meet the rigorous quality standards of global fashion brands.

Read More: Vietnam: A Booming Hub for Quality Inspections and Audits in Global Supply Chains

Technological and Infrastructure Support

Thailand

- Thailand has been steadily increasing its investment in technological innovation. In the manufacturing sector, many companies are adopting advanced production technologies such as automation, robotics and 3D printing. In the automotive industry, Thai manufacturers are utilizing automated assembly lines, which not only enhance production efficiency but also improve the precision and quality of vehicle assembly. In the electronics industry, companies are investing in high-precision manufacturing equipment for component production, ensuring that their products meet the stringent quality standards of international markets.

- The country's infrastructure is a significant advantage. Thailand boasts a well-developed transportation network, including an extensive road system, deep-sea ports such as Laem Chabang Port and international airports like Suvarnabhumi Airport. This infrastructure facilitates the efficient movement of raw materials and finished products, reducing lead times and ensuring the smooth operation of production processes. In the Eastern Economic Corridor (EEC), modern infrastructure has attracted numerous high-tech industries, creating industry clusters that promote knowledge sharing, collaboration and the development of a more skilled workforce.

Vietnam

- Vietnam has been aggressively pursuing digital transformation and "Industry 4.0" adoption. In the manufacturing sector, foreign and local enterprises are increasingly integrating automation and data exchange into production technologies. In the automotive and e-mobility sector, manufacturers utilize fully automated robotic arms for welding and painting, which significantly enhances precision and consistency compared to manual methods. In the electronics sector, companies are investing in surface-mount technology (SMT) lines and automated optical inspection (AOI) systems to ensure zero-defect production for high-value components.

- The country's infrastructure has become a strategic asset for global supply chains. Vietnam has developed a robust logistics network, highlighted by deep-sea ports such as the Cai Mep-Thi Vai Port complex in the south and Lach Huyen Port in the north. These ports can accommodate large mother vessels, allowing for direct shipping to US and European markets without transshipment, thereby reducing lead times. Additionally, the development of the Long Thanh International Airport is set to further boost air cargo capacity for high-tech goods. Similar to Thailand's EEC, Vietnam has established High-Tech Parks (such as the Saigon Hi-Tech Park) and specialized industrial zones. These clusters foster close proximity between component suppliers and assemblers, facilitating just-in-time (JIT) delivery and lowering inventory costs while maintaining high production standards.

Read More: What Makes Vietnam one of Asia's Hottest Manufacturing Hubs?

Quality Assurance Practices in Thailand

- Thai companies implement a range of quality assurance practices to ensure consistent production quality. Industry associations play a vital role in establishing and promoting quality standards. For instance, the Thai Textile Institute (TTI) sets quality benchmarks for the textile industry, addressing factors such as fabric quality, colorfastness and manufacturing processes. These standards are widely embraced by Thai textile manufacturers, contributing to the maintenance of high-quality levels throughout the industry.

- Internally, Thai companies often implement strict quality control processes. In the food processing industry, they conduct regular quality checks at every stage of production, from raw material inspection to final packaging. These companies also adhere to international food safety standards, such as Hazard Analysis and Critical Control Points (HACCP). In the electronics industry, manufacturers utilize advanced testing equipment to perform rigorous quality inspections on components and finished products, including tests for electrical performance, durability and environmental resistance.

Read More: Why Choose Third-Party Inspection Services in Thailand | Testcoo

Quality Assurance Practices in Vietnam

- Vietnamese companies implement rigorous quality assurance practices to secure their position in the global supply chain. Industry associations are pivotal in maintaining these standards. For instance, the Vietnam Textile and Apparel Association (VITAS) actively encourages members to adopt international sustainability and quality certifications such as OEKO-TEX and WRAP, ensuring that Vietnamese textiles meet global safety and durability benchmarks.

- Internally, strict quality control processes are embedded in production lines. In the food processing and seafood export industry, companies strictly adhere to international safety management systems, including HACCP (Hazard Analysis and Critical Control Points) and ISO 22000. Regular audits cover every stage from aquaculture farming to final packaging to comply with stringent EU and US FDA regulations. In the electronics and mechanical engineering sectors, manufacturers utilize advanced metrology equipment and undergo regular third-party audits to verify product specifications and performance durability. Furthermore, the Directorate for Standards, Metrology and Quality (STAMEQ) continually harmonizes national standards (TCVN) with international norms (ISO/IEC), creating a regulatory framework that supports reliable, high-quality production.

Read More:Services Quality Inspection in Vietnam

Frequently Asked Questions (FAQs)

1. How do I verify the quality of suppliers in Vietnam and Thailand before placing an order?

You can conduct a Factory Audit or Supplier Assessment to verify a supplier’s production capacity, quality management systems, certifications and working conditions. Many buyers rely on third-party inspection companies, such as Testcoo, to perform on-site evaluations, ensuring that suppliers meet industry standards like ISO, IEC and EN.

2. Are production standards in Vietnam and Thailand consistent across factories?

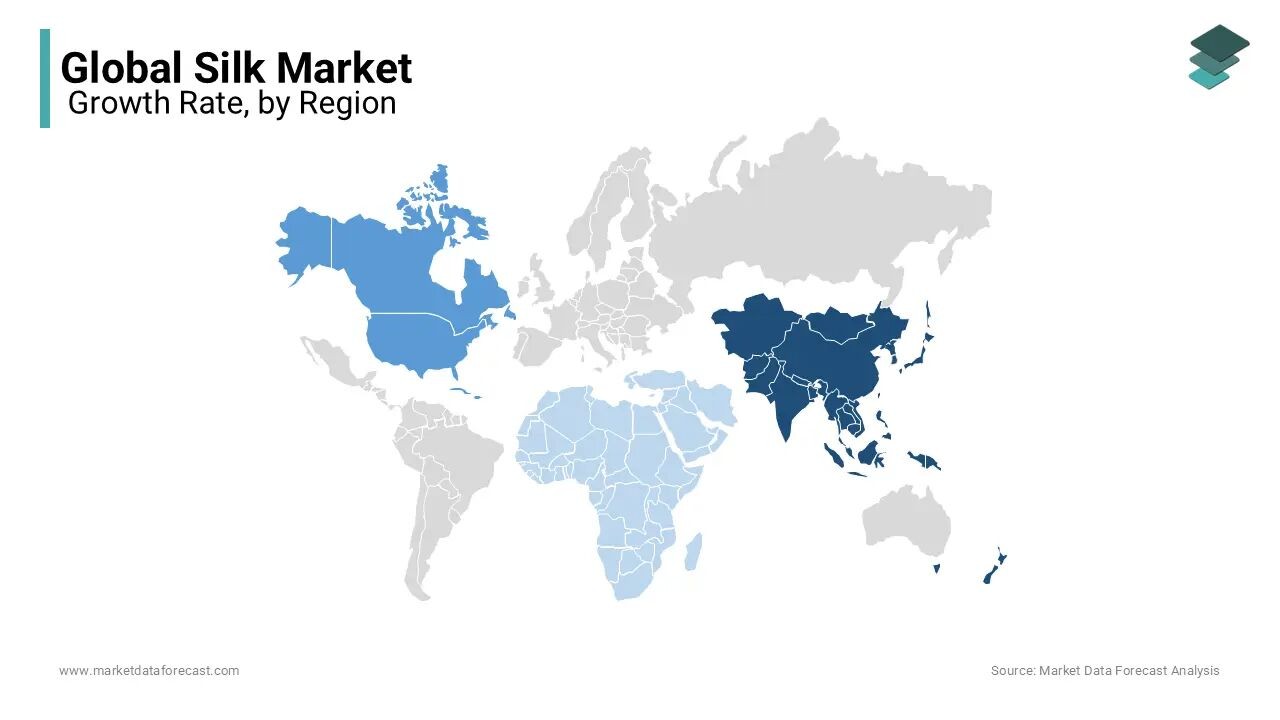

Standards can vary significantly depending on factory size, experience and industry. Large manufacturers typically adhere to strict quality protocols, while smaller factories may have less consistent processes. Conducting structured inspections, such as Initial Production Checks, During Production (DUPRO) inspections, and Final Random Inspections, helps ensure consistent quality across orders.

3. What is the biggest quality risk when sourcing from Vietnam and Thailand?

The most common risks include unstable production timelines, inconsistent material sourcing and limited visibility on the factory floor. Without independent verification, buyers may encounter delayed shipments or quality deviations. Third-party quality control (QC) significantly mitigates these risks by offering real-time transparency and objective oversight.

4. Do suppliers in Vietnam and Thailand comply with international standards like ISO, IEC and EU regulations?

Many medium to large factories comply with international standards, particularly in the electronics, textiles and consumer goods sectors. However, compliance levels vary and documentation is not always complete. Buyers frequently request audits and product testing to verify conformity with ISO 9001, ISO 14001, IEC safety standards and EU GPSR requirements.

5. When should I use third-party inspections for orders placed in Vietnam or Thailand?

Third-party inspections are recommended at key checkpoints: before production begins, during production at 20–60 percent completion and before shipment. These inspections help detect defects early, monitor progress and verify the final product's quality. For high-value or time-sensitive orders, continuous production monitoring offers additional reliability.

Why Is Testcoo a Trusted Partner for Vietnam and Thailand Quality Management?

Testcoo is widely recognized as a reliable quality partner for brands sourcing from Vietnam and Thailand due to its service model, which emphasizes global coverage, speed and transparency. With an inspection network spanning all major manufacturing hubs across Southeast Asia, Testcoo can quickly dispatch experienced inspectors, even to remote factory locations. This regional presence eliminates delays, enhances communication with suppliers and ensures consistent service regardless of the production site.

Multilingual communication support facilitates smoother cross-border collaboration for both buyers and suppliers. Whether coordinating with Vietnamese factories or Thai exporters, Testcoo’s teams help bridge language barriers to prevent misunderstandings and ensure inspection criteria are clearly implemented on-site. Every report is delivered promptly and often within 24 hours, providing importers with the visibility needed to make fast, informed decisions. Transparent pricing with no hidden fees further reinforces confidence, establishing Testcoo as a reliable long-term partner for quality management in both markets.

How Can You Strengthen Your Supply Chain in Southeast Asia with Testcoo?

A resilient supply chain in Southeast Asia demands visibility, verified quality and proactive risk management. Testcoo addresses these needs with a comprehensive suite of services tailored for global buyers collaborating with Vietnamese and Thai suppliers. Through product inspections, supplier evaluations, social compliance audits and production monitoring, Testcoo helps you identify issues early, minimize shipment delays and prevent costly rework or returns.

With real-time reporting, professional defect analysis and standardized inspection processes, Testcoo enables you to maintain consistent quality across diverse factory partners throughout the region. Whether you are expanding production into Vietnam, shifting procurement to Thailand, or managing multi-country sourcing, Testcoo ensures that every step is monitored with precision and transparency.

To enhance your supply chain performance across Southeast Asia, connect with Testcoo today. Our team can assist you in scheduling inspections, audits and ongoing production monitoring tailored to your sourcing strategy.

Free Sample Report Performance Quality Control

Download a sample report to keep control of your supply chain!

Featured Articles

AQL Table | How to Read It

AQL Table | How to Read It TOP 10 Common Defects in Garments Quality Inspection

TOP 10 Common Defects in Garments Quality Inspection Product Packaging and Shipment Label requirements for Amazon FBA

Product Packaging and Shipment Label requirements for Amazon FBA What Is ASTM-F2413-18? Protective Footwear Standard

What Is ASTM-F2413-18? Protective Footwear Standard How to Conduct Third-Party Quality Control Inspections for Electric Scooters

How to Conduct Third-Party Quality Control Inspections for Electric Scooters SMETA Audit-What is SMETA Audit?

SMETA Audit-What is SMETA Audit? TESTCOO Supplier Verification/Certification Service SLCP, Higg FEM, GRS, GOTS

TESTCOO Supplier Verification/Certification Service SLCP, Higg FEM, GRS, GOTS Quality Control Inspection Company in China

Quality Control Inspection Company in China What is Quality Inspection? A Complete Guide

What is Quality Inspection? A Complete Guide Guidelines for Product Inspection in India

Guidelines for Product Inspection in India

Category

- Production Inspection Service

- Factory Audit

- Softline Inspection

- Hardline Inspection

- Electrics Inspection

- Certification

- Checklist

- Manufacturers

- Quality Assurance Basics

- Products Recall

- AQL

- Guidence and Standard

- News

- Supplier Management

- Amazon

- Protective Equipment

- e-commerce quality control

- Indian Manufacturing

- Soft Goods Quality Control

- Supply Chain Management

- Supply Chain Resilience

- E-Commerce Quality Control

- ISO 2859

- Supply Chain Optimization

- Garment Industry

- Higg Index