Building Trust with Overseas Buyers in Malaysia and Singapore through Product Inspection

Malaysia and Singapore are powerhouses in the global trade landscape, particularly in the electronics and consumer goods sectors. According to data from the Malaysia External Trade Development Corporation (MATRADE), Malaysia’s electronics exports reached approximately USD 75 billion in 2024, accounting for 38% of the country’s total export value. Meanwhile, Singapore leveraged its status as a regional trade hub to record electronics exports worth USD 68 billion in the same year, with over 70% of these goods destined for markets in Europe, North America, and Southeast Asia. These figures underscore the critical role both nations play in keeping global supply chains running; however, they also highlight the immense pressure exporters face to meet the rigorous demands of overseas buyers.

For exporters, product inspection has emerged as a practical solution for reducing risks, protecting their reputation, and building trust with overseas buyers. Two inspection practices stand out: During-Production Inspection (DUPRO) and Final Random Inspection (FRI). By implementing these quality control measures, exporters in Malaysia and Singapore can improve their on-time delivery performance, minimize costly returns, and strengthen long-term buyer relationships.

This article explores the unique challenges faced by exporters in these two nations, the tangible value of DUPRO and FRI, and how these inspections translate into lasting buyer confidence.

What Challenges Do Exporters Face in Malaysia and Singapore?

Although Malaysia and Singapore boast world-class manufacturing infrastructure, exporters in both countries grapple with industry-specific challenges that threaten their ability to retain overseas buyers. These hurdles are amplified by the high stakes of the electronics sector, where even minor defects can render products useless or dangerous.

1. Hidden Quality Risks in Complex Production Cycles

Electronics manufacturing in Malaysia and Singapore often involves intricate assembly processes, with components sourced from multiple suppliers throughout Southeast Asia. A 2024 report by the Malaysian Electronics Manufacturers Association (MEMA) found that 42% of product defects stem from “upstream component issues” that go undetected until late-stage production. For example, a Kuala Lumpur-based exporter producing lithium-ion batteries for electric vehicles (EVs) discovered a batch of faulty cathode materials only after 80% of the production run was completed. The result? A USD 2.3 million loss from scrapping defective units, plus a six-week delay in fulfilling a European buyer’s order, ultimately leading to a 15% reduction in the buyer’s next order volume.

2. Regulatory Complexity Across Target Markets

Overseas buyers in key markets, such as the European Union (EU), United States, and Japan, impose strict compliance requirements that often vary dramatically. Malaysia’s Ministry of International Trade and Industry (MITI) estimates that 30% of export delays in 2024 will be due to non-compliance with foreign regulations.

Singaporean exporters face similar challenges, despite the country’s reputation for strict quality control. A Singapore-based manufacturer of medical devices learned this the hard way when customs rejected a shipment of glucose monitors to Australia. The monitors met Singapore’s local standards but failed to comply with Australia’s Therapeutic Goods Administration (TGA) labeling requirements, which mandate specific warning symbols for battery disposal. The delay cost the exporter SGD 150,000 in storage fees and lost sales, and it took two months to re-label and re-ship the products.

3. Supply Chain Disruptions and Delivery Pressures

Global supply chain volatility from port congestion to raw material shortages has made on-time delivery a persistent challenge. In 2024, the Port of Tanjung Pelepas, Malaysia’s busiest container port, experienced a 14-day backlog due to labor shortages, while Singapore’s Port faced delays caused by increased shipping traffic. For exporters, these disruptions intensify the pressure to expedite production, thereby increasing the risk of defects.

4. Reputational Damage and Lost Business

In the age of social media and instant feedback, a single quality issue can spread rapidly and erode buyer trust. A Singaporean exporter of consumer electronics saw its Amazon seller rating drop from 4.8 to 3.2 stars in 2024 after a batch of wireless earbuds developed battery issues within weeks of sale. The buyer, a U.S.-based e-commerce platform received over 500 customer complaints, leading them to terminate their partnership with the exporter. The exporter estimated an annual business loss of USD 1.8 million.

Without a structured inspection process, exporters in Malaysia and Singapore are vulnerable to these risks. DUPRO and FRI address these challenges head-on, transforming reactive damage control into proactive quality management.

Why Is During Production Inspection (DUPRO) Valuable for Exporters?

During-Production Inspection (DUPRO) is a quality control process conducted when 20% to 80% of production is complete. Unlike Final Random Inspection, which focus on finished goods, DUPRO evaluates semi-finished products, production processes, and factory conditions. This approach allows exporters to identify issues early and implement corrections before it is too late. For Malaysian and Singaporean electronics exporters, DUPRO is not merely a quality control tool; it is a strategic investment in efficiency and risk mitigation.

1. Early Defect Detection: Stopping Problems Before They Escalate

The biggest advantage of DUPRO is its ability to identify defects in the middle of production, rather than after a full batch is completed.

In Singapore, a manufacturer of LED lighting fixtures used DUPRO to address a problem with wire insulation. Inspectors found that the insulation on 15% of the wires was too thin, which would have violated the U.S. Underwriters Laboratories (UL) safety standard. By correcting the issue mid-production, the exporter avoided a potential recall and maintained its UL certification, which is critical for retaining its U.S. retail partners.

2. Production Progress Monitoring: Ensuring On-Time Delivery

DUPRO is not just about quality; it also provides exporters with real-time visibility into production timelines. Many overseas buyers require regular updates on order progress, and DUPRO reports provide objective data on whether production is on track.

Singaporean exporters, who often handle high-volume and time-sensitive orders, also benefit from this visibility. A Singapore-based contract manufacturer producing IoT sensors for a European technology company used DUPRO to identify a bottleneck in the testing phase. By reallocating staff and equipment based on the DUPRO report, the exporter reduced the testing time by 30% and met their delivery deadline avoiding a SGD 50,000 late fee.

3. Cost Savings: Reducing Rework and Waste

Defects discovered late in production often require scrapping entire batches or expensive rework. DUPRO minimizes these costs by addressing issues early. A 2024 study by the Singapore Manufacturing Federation (SMF) found that exporters who implemented DUPRO reduced rework costs by an average of 45%.

DUPRO also helps exporters avoid the hidden costs of delayed shipments, such as storage fees, airfreight surcharges, and penalties.

4. Compliance Assurance: Meeting Buyer and Regulatory Standards

Many overseas buyers now require DUPRO as part of their supplier agreements, as it demonstrates that exporters are committed to meeting their specifications and supports compliance with international regulations.

Read More:During Production Inspection (DUPRO): A Complete Guide

↵

What Role Does Final Random Inspection (FRI) Play in Quality Control?

While DUPRO focuses on preventing issues during production, Final Random Inspection (FRI) serves as the final quality checkpoint before goods leave the factory. Conducted when 100% of production is complete and goods are packaged for shipment, FRI involves sampling finished products and verifying that they meet the buyer’s quality, quantity, packaging, and compliance requirements. For Malaysian and Singaporean exporters, FRI is the last line of defense against costly shipment rejections and buyer disputes.

1. Verifying Compliance with Buyer Specifications

Overseas buyers rely on FRI to confirm that the products they ordered meet their exact requirements. This is especially critical for electronics, where even minor deviations, such as incorrect labeling or missing accessories, can lead to rejected shipments.

2. Reducing the Risk of Customs Rejections

Many countries require FRI certificates to clear customs, particularly for regulated products, such as electronics, medical devices, and toys. Without a valid FRI report, shipments may be held at the border, leading to delays and additional expenses.

Similarly, India’s Bureau of Indian Standards (BIS) requires FRI for electronic products. A Singaporean exporter of LED TVs used FRI to obtain a BIS certificate, ensuring that the TVs met India’s voltage and safety standards. The shipment cleared Indian customs without issues, and the exporter was able to expand their presence in the Indian market.

Related Article: WTO | Technical Barriers to Trade

3. Minimizing Return and Recall Risks

Returns and recalls are among the most costly issues faced by exporters. A single recall can cost hundreds of thousands of dollars in logistics, rework and reputational damage. FRI helps prevent this by catching defects before products reach buyers.

4. Building Transparency with Buyers

FRI reports provide buyers with objective third-party evidence of product quality. This transparency is crucial for building trust, especially when buyers are located thousands of miles away and cannot inspect goods themselves. Many exporters share FRI reports with buyers before shipment, providing them with the opportunity to address any concerns.

Singaporean exporters also use FRI to differentiate themselves from competitors. A Singapore-based exporter of smart home devices includes FRI certificates in its marketing materials, highlighting its commitment to quality. This strategy has helped them win contracts with major retailers in Australia and New Zealand, who value independent verification of product quality.

Read More:Final Random Inspection: Your Last Line of Defense Before Shipping

How DUPRO and FRI Build Buyer Confidence?

Trust is the foundation of successful international trade. For overseas buyers, working with exporters in Malaysia and Singapore means navigating geographical distance, cultural differences, and regulatory complexities, all of which can create uncertainty. DUPRO and FRI address this uncertainty by providing tangible evidence of quality and reliability, transforming skepticism into confidence.

1. Demonstrating Proactive Quality Management

When exporters invest in DUPRO and FRI, they send a clear message to buyers: “We take quality seriously, and we’re willing to invest in ensuring your satisfaction.” This proactive approach stands out in a market where many exporters still rely on reactive quality control.

2. Providing Objective, Third-Party Verification

Buyers often view in-house quality reports with skepticism because they may be biased. DUPRO and FRI, conducted by independent third-party inspectors such as Testcoo, offer unbiased verification of product quality. This independence is critical for building trust, especially among new buyers. A U.S. retailer told Testcoo that they “never work with a new exporter without seeing third-party inspection reports.” For a Singaporean kitchen appliance exporter, this meant sharing DUPRO and FRI reports with a new U.S. buyer.

Third-party reports also help resolve disputes between exporters and buyers. The exporter provided Testcoo’s FRI report, which showed that the phones met all specifications. The buyer accepted the report, and the dispute was resolved without costly legal action or lost business.

3. Ensuring Consistency Across Shipments

Buyers value consistency; they want to know that every shipment will meet the same high standards as the first. DUPRO and FRI help exporters maintain consistency by establishing clear quality benchmarks and monitoring compliance over time. Consistency also helps exporters build a reliable reputation.

4. Supporting Long-Term Partnerships

Trust built through DUPRO and FRI often leads to long-term mutually beneficial partnerships. Buyers who are confident in an exporter’s quality are more likely to place larger orders, offer longer contracts, and collaborate on developing new products.

Frequently asked questions (FAQs)

1.What types of product inspections are most common in Malaysia and Singapore?

Initial Production, DUPRO, Final Random Inspection, Loading Supervision, 100% Inspection.

2.How does third party inspection differ from in house QC?

Third party inspection provides independent, unbiased assessments across multiple suppliers, while in house QC relies on internal staff and resources.

↵

3.Can product inspection reduce the risk of returns and disputes?

Yes, systematic inspections help detect defects early, preventing costly rework, returns, and shipment delays.

4.Do overseas buyers prefer suppliers who use third party inspections?

Yes, because verified inspections demonstrate commitment to quality and compliance, giving international buyers more confidence.

5.What industries in Malaysia and Singapore benefit most from inspections?

Key sectors include electronics, textiles, consumer goods, and manufacturing for export.

How Can Inspection Strengthen Global Competitiveness?

For exporters in Malaysia and Singapore, the global marketplace is both an opportunity and a challenge. While the two countries’ advanced manufacturing capabilities and strategic locations provide a strong foundation for export success, the rising expectations of overseas buyersfor quality, compliance, and reliabilitydemand a proactive approach to quality control. DUPRO and FRI are not only tools for identifying defects; they are strategic investments in trust, efficiency, and long-term growth.

The evidence is clear: exporters who implement DUPRO and FRI see tangible benefits: lower defect rates, fewer delivery delays, reduced costs, and stronger buyer relationships. As the case studies show, these inspections can transform struggling businesses into industry leaders, opening doors to new markets and larger contracts. In an era where trust is the most valuable currency in international trade, DUPRO and FRI provide proof that buyers need to feel confident in their suppliers.

For Malaysian and Singaporean exporters looking to compete on the global stage, the message is simple: quality inspection is no longer optional. It is necessary to build trust with overseas buyers, protect your reputation, and achieve sustainable export success. By partnering with a trusted third-party inspection provider, such as Testcoo, exporters can ensure that their products meet the highest standardsand that their buyers have every reason to keep coming back.

Ultimately, product inspection is more than just a quality control measure. It is a bridge between exporters in Malaysia and Singapore and the global buyers who rely on their products. It is the key to turning transactions into partnerships and partnerships into long-term success.

Free Sample Report Performance Quality Control

Download a sample report to keep control of your supply chain!

Featured Articles

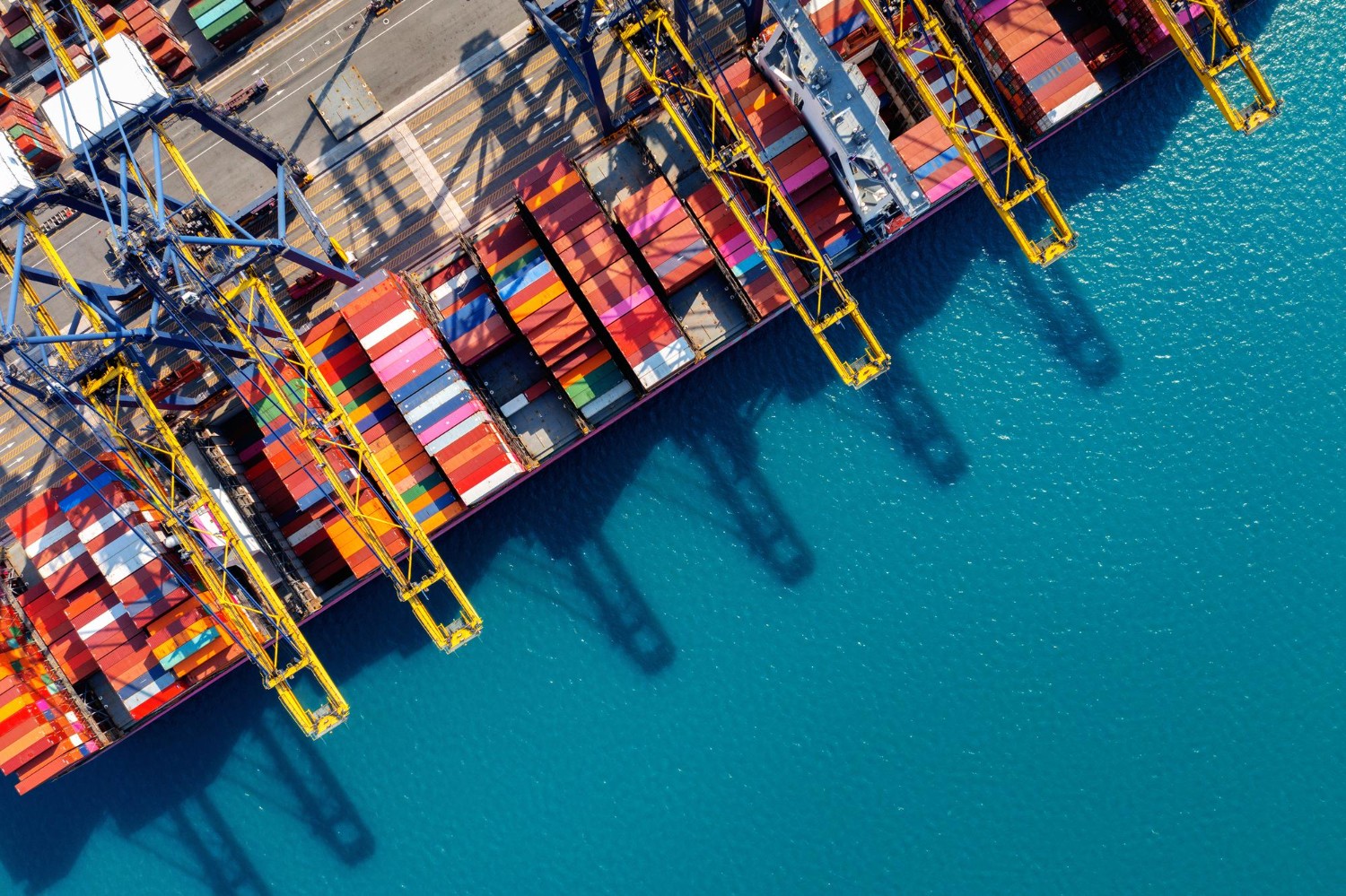

AQL Table | How to Read It

AQL Table | How to Read It TOP 10 Common Defects in Garments Quality Inspection

TOP 10 Common Defects in Garments Quality Inspection Product Packaging and Shipment Label requirements for Amazon FBA

Product Packaging and Shipment Label requirements for Amazon FBA What Is ASTM-F2413-18? Protective Footwear Standard

What Is ASTM-F2413-18? Protective Footwear Standard How to Conduct Third-Party Quality Control Inspections for Electric Scooters

How to Conduct Third-Party Quality Control Inspections for Electric Scooters SMETA Audit-What is SMETA Audit?

SMETA Audit-What is SMETA Audit? TESTCOO Supplier Verification/Certification Service SLCP, Higg FEM, GRS, GOTS

TESTCOO Supplier Verification/Certification Service SLCP, Higg FEM, GRS, GOTS Quality Control Inspection Company in China

Quality Control Inspection Company in China What is Quality Inspection? A Complete Guide

What is Quality Inspection? A Complete Guide Guidelines for Product Inspection in India

Guidelines for Product Inspection in India

Category

- Production Inspection Service

- Factory Audit

- Softline Inspection

- Hardline Inspection

- Electrics Inspection

- Certification

- Checklist

- Manufacturers

- Quality Assurance Basics

- Products Recall

- AQL

- Guidence and Standard

- News

- Supplier Management

- Amazon

- Protective Equipment

- e-commerce quality control

- Indian Manufacturing

- Soft Goods Quality Control

- Supply Chain Management

- Supply Chain Resilience

- E-Commerce Quality Control

- ISO 2859

- Supply Chain Optimization

- Garment Industry

- Higg Index