Exploring the Growing Demand for Halal Certification Inspections in Indonesia and Malaysia

The Surge of the Global Halal Market

In recent years, the global halal market has experienced significant growth, driven largely by the increasing Muslim population worldwide. Currently, there are over 2 billion Muslims globally, a number that is expected to rise steadily over the coming decades. According to data from the Pew Research Center, by 2050 Muslims will account for approximately 30% of the global population. This demographic shift has fueled a growing demand for halal-compliant products—ranging from food and beverages to cosmetics and pharmaceuticals.

Among all regions, Indonesia and Malaysia stand out as two major powerhouses in the halal market. Indonesia, with the world's largest Muslim population, presents a massive consumer base for halal products. Malaysia, on the other hand, has positioned itself as a global hub for halal industries. It boasts advanced infrastructure, strict regulatory frameworks, and internationally recognized halal certification systems that attract businesses both domestically and internationally.

In this thriving market, halal certification inspections play a pivotal role. They serve as a safeguard, ensuring that products adhere to the stringent religious and quality standards outlined by Islamic law. For consumers, halal-certified products offer assurance of religious compliance. For businesses, obtaining halal certification not only opens access to large Muslim-majority markets but also enhances brand reputation by signaling quality, safety, and ethical production practices.

Current Status of Halal Certification Inspection Demand in Indonesia and Malaysia

The Indonesian Market

In Indonesia, the demand for halal certification inspections has seen a remarkable upward trend. According to data from the Indonesian Ministry of Trade, the number of enterprises applying for halal certification has steadily increased year by year. In 2019, approximately 50,000 enterprises applied for halal certification. This number grew to over 60,000 by 2022—a growth rate of around 20% within three years.

This growth is also evident in the market size. In 2022, the halal food market in Indonesia was valued at $24 billion and is projected to grow at an annual rate of approximately 7%. Beyond food, the halal cosmetics and pharmaceutical sectors are also booming. For instance, the halal cosmetics market in Indonesia has been growing at an annual rate of 15% in recent years. Increased consumer awareness and government initiatives to promote the halal industry have been key drivers of this growth.

The Malaysian Market

Malaysia is also witnessing strong momentum in the demand for halal certification inspections. The Department of Islamic Development Malaysia (JAKIM) reports that the number of halal-certified companies has been on a consistent rise. In 2020, there were over 19,000 halal-certified companies; by 2023, the number exceeded 22,000—representing a 16% increase in three years.

Malaysia's halal industry also has a substantial global presence. The country’s halal exports reached $24.4 billion in 2022, marking an 8% year-on-year growth. With government support and a robust halal ecosystem, Malaysia has become a key destination for businesses seeking halal certification, further fueling demand for inspections.

Read more about Global halal market-statistics & facts.

Factors Driving Demand Growth

A Vast Muslim Consumer Base

Indonesia and Malaysia both have large Muslim populations, which form the core consumer base for halal-certified products. In Indonesia, nearly 230 million Muslims—about 87% of the population—strictly follow Islamic dietary and consumption rules. They choose only halal-certified products, avoiding non-halal ingredients like pork and alcohol. This cultural habit drives strong demand in both large supermarkets and local markets.

In Malaysia, where Islam is the official religion and 63% of the population is Muslim, there is similarly high demand. Malaysian Muslims are attentive not only to food but also to the halal status of cosmetics, pharmaceuticals, and everyday goods. This robust consumer demand in both countries creates a vast market for halal-certified products and directly drives the need for certification inspections.

Government Support and Market Regulation

The governments of both Indonesia and Malaysia have introduced policies to support the halal industry, contributing to the growing demand for certification.

Indonesia implemented mandatory halal certification starting in 2024. Under this policy, nearly all food, beverage, cosmetic, and pharmaceutical products must be certified halal, with few exceptions. The Badan Penyelenggara Jaminan Produk Halal (BPJPH) oversees standards, inspections, and certifications. The government also provides tax incentives and financial support to SMEs producing halal products, encouraging more businesses to enter the market.

Malaysia has a well-established halal certification and monitoring system led by JAKIM. It enforces strict inspections from raw material sourcing to packaging and storage. The government also promotes halal R&D by supporting enterprises and research institutions, aiming to enhance Malaysia’s competitiveness in the international market. These initiatives regulate the market and encourage businesses to pursue halal certification.

How to Conduct Halal Certification

Halal certification inspections are rigorous, ensuring compliance with religious and quality standards. The process typically involves the following stages:

Application Stage

- Submitting Materials: Enterprises must submit documents such as business licenses, production permits, product formulas, and process flowcharts. These help assess the potential for halal compliance. For instance, a food company must specify whether each ingredient is of animal, plant, or synthetic origin and whether it adheres to Islamic laws.

- Choosing a Certification Body: In Indonesia, BPJPH is the primary authority. In Malaysia, it’s JAKIM. Private recognized agencies also exist in both countries. Businesses should consider the body’s credibility, market recognition, and cost-efficiency.

Review Stage

- Document Review: The certification body examines submitted documents to ensure accuracy and compliance. Suspicious ingredients or processes must be clarified.

- On-site Audit: Inspectors visit facilities to verify practices. Raw materials must be segregated, equipment sanitized, and slaughter methods must follow Islamic rituals. Any violations can lead to disqualification.

Certification Decision and Follow-up

- Certification: If all standards are met, the enterprise receives a halal certificate.

- Ongoing Supervision: Certified companies face regular or random audits. Non-compliance can result in suspension or revocation of certification, impacting market access.

The Crucial Role of Digital Traceability Technology in Halal Certification Inspections

Principles and Advantages

Digital traceability technologies—such as blockchain, IoT, and QR codes—have transformed halal compliance monitoring.

- Blockchain offers a tamper-proof record of a product’s journey from raw material to shelf.

- IoT devices capture real-time data (e.g., temperature, humidity, location).

- QR codes allow consumers to access product origin and certification details.

These technologies enhance transparency, improve accuracy, and ensure rapid response in the event of compliance issues.

Application in Halal Certification

- Raw Material Procurement: Supplier data, including animal origin and slaughter method, is recorded on blockchain platforms.

- Production & Processing: Sensors detect deviations in process or contamination risks and trigger alerts.

- Packaging & Transportation: QR codes or RFID tags track product handling. IoT monitors shipping conditions to ensure integrity.

- Sales: Consumers scan QR codes for full traceability and halal verification, enhancing trust and purchase confidence.

The surge in demand for halal certification inspections in Indonesia and Malaysia is driven by a large Muslim consumer base and robust government support. This trend reflects broader growth in the global halal industry.

Digital traceability technologies are revolutionizing the inspection process, offering unprecedented transparency and reliability. Businesses seeking to enter or expand in halal markets must adapt to these innovations.

Testcoo's Services in Halal Certification Inspections

Our Professional Service Offerings

At Testcoo, we provide a full suite of services to support enterprises through the halal certification journey.

- Expert Certification Consultation: Our team understands the halal standards in Indonesia, Malaysia, and global markets. We provide tailored guidance for compliance.

- Pre-Inspection Support: We help prepare documentation, assess processes, and conduct mock audits.

- On-Site Inspection Coordination: We coordinate with certified bodies to streamline the audit process.

- Digital Traceability Integration: We offer solutions to integrate traceability systems into your operations for greater transparency and efficiency.

Whether you're entering new halal markets or enhancing your current compliance, Testcoo is your trusted partner in halal certification inspections. Contact us today to unlock new opportunities in the growing global halal industry.

Ready to tap into the booming halal market?

Media heading

Free Sample Report Performance Quality Control

Download a sample report to keep control of your supply chain!

Featured Articles

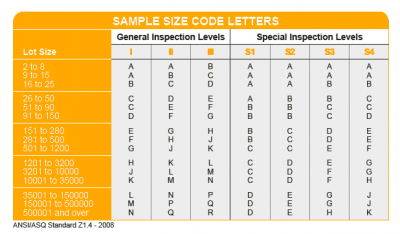

AQL Table | How to Read It

AQL Table | How to Read It TOP 10 Common Defects in Garments Quality Inspection

TOP 10 Common Defects in Garments Quality Inspection Product Packaging and Shipment Label requirements for Amazon FBA

Product Packaging and Shipment Label requirements for Amazon FBA What Is ASTM-F2413-18? Protective Footwear Standard

What Is ASTM-F2413-18? Protective Footwear Standard How to Conduct Third-Party Quality Control Inspections for Electric Scooters

How to Conduct Third-Party Quality Control Inspections for Electric Scooters SMETA Audit-What is SMETA Audit?

SMETA Audit-What is SMETA Audit? TESTCOO Supplier Verification/Certification Service SLCP, Higg FEM, GRS, GOTS

TESTCOO Supplier Verification/Certification Service SLCP, Higg FEM, GRS, GOTS Quality Control Inspection Company in China

Quality Control Inspection Company in China What is Quality Inspection? A Complete Guide

What is Quality Inspection? A Complete Guide Guidelines for Product Inspection in India

Guidelines for Product Inspection in India

Category

- Production Inspection Service

- Factory Audit

- Softline Inspection

- Hardline Inspection

- Electrics Inspection

- Certification

- Checklist

- Manufacturers

- Quality Assurance Basics

- Products Recall

- AQL

- Guidence and Standard

- News

- Supplier Management

- Amazon

- Protective Equipment

- e-commerce quality control

- Indian Manufacturing

- Soft Goods Quality Control

- Supply Chain Management

- Supply Chain Resilience

- E-Commerce Quality Control

- ISO 2859

- Supply Chain Optimization

- Garment Industry

- Higg Index